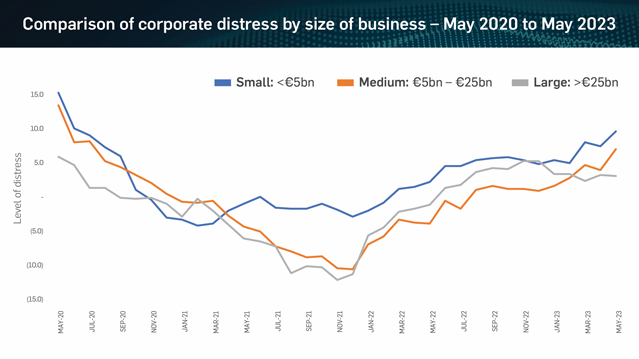

Corporate distress across European markets remains elevated, driven by pressures on liquidity and weakening investment amongst small and medium sized corporates, according to the latest Weil European Distress Index.

The quarterly study, which aggregates data from more than 3,750 listed corporates and financial market indicators, reveals a widening gulf in distress levels according to company size. The Retail & Consumer sector, where corporates under €5 billion in market capitalization face disproportionate pressure driven by investor sentiment. Over the past two years, such corporates have seen their share prices fall by over 16%, whereas large corporates – those with a market capitalization of over €25 billion – have seen share prices increase by 16%.

Distress among UK corporates rose on the previous quarter and is significantly above last year’s levels. The UK remains the most distressed major market in Europe, markedly higher than France, Spain and Italy.

In contrast to other major economies, inflation has continued to climb in the UK, with the Bank of England hiking interest rates to 5% in June 2023 – a record 13th consecutive increase. Mortgage costs have also risen, placing pressure on millions of households that are rolling off fixed rate mortgages, and that are already battling a cost-of-living crisis.

Corporates in Germany remained the second most distressed country across the European markets measured, and are now at their highest level since November 2020. Distress has been pushed higher by poorer investment metrics, pressure on liquidity and lower appetite for risk. With an overreliance on manufacturing and a drop in consumer confidence, Germany’s economy is expected to contract further this year.

Elsewhere, levels of distress across corporates in France have risen sharply, driven by weaker investment metrics, and pressure on liquidity and profitability. Inflation remains a key concern. However, latest IMF forecasts remain unchanged, with GDP in France expected to rise by 0.7% in 2023, ahead of Germany, the UK and levelling Italy.

Corporates headquartered in Spain and Italy saw levels of distress rise slightly during the latest period, but remain well below the UK, Germany and France. The economic outlook for Spain and Italy is more upbeat than in other major European economies, with inflationary pressures having eased considerably in the last few months.

Sector trends

Distress across European Real Estate corporates remained at elevated levels, driven higher in the latest period by rising pressures on liquidity, softer investment metrics and squeezed profitability. A combination of rising interest rates, higher debt servicing costs and structural changes in the labour market, causing a fall in demand for office space, is putting intense pressure on the market. In the residential market, rising interest rates are also impacting housing affordability, softening the outlook for house prices.

Healthcare corporates in Europe have seen distress levels accelerate in the last quarter. Higher levels of distress are likely to be driven by unprecedented support during the pandemic, with rising interest rates and operating costs squeezing profit margins.

Meanwhile, distress across European Financial Services firms was driven to its highest level since October 2020, with a sharp deterioration in market fundamentals driving the overall rise.

Corporate distress can be defined as uncertainty about the fundamental value of financial assets, volatility and increases in perceived risk. It also refers to the disruption of the normal functioning of companies’ financial performance. There are several common characteristics of corporate distress: liquidity pressures, reduced profitability, rising insolvency risk, falling valuations and reduced return on investment.

Contributor(s)

More from the Weil European Restructuring Blog

This website is maintained by Weil, Gotshal & Manges LLP in New York, NY © 2020 Weil, Gotshal & Manges LLP, All Rights Reserved. The contents of this website may contain attorney advertising under the laws of various states. Quotation with attribution is permitted. This publication is provided for general information purposes only and is not intended to cover every aspect of the purpose for the law. The information in this publication does not constitute the legal or other professional advice of Weil London or the authors. The views expressed in this publication reflect those of the authors and are not necessarily the views of Weil London or of its clients. These materials may contain attorney advertising. Prior results do not guarantee a similar outcome.