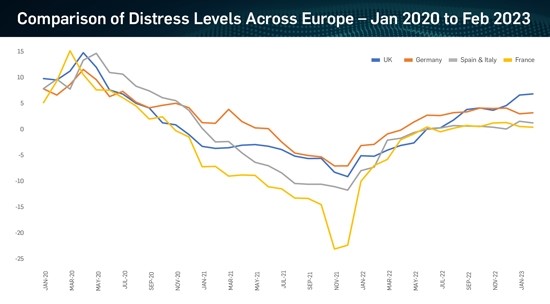

Corporate distress in the UK has risen to its highest level since June 2020, despite easing marginally across other key European markets, according to the latest Weil European Distress Index.

The quarterly study, which aggregates data from more than 3,750 listed corporates and financial market indicators, reveals an increasingly mixed picture across Europe. While remaining above long-run average levels, distress has eased in most key European markets, a result of moderating expectations of a deep and prolonged recession throughout the continent, with faster falls in inflation and a stronger boost from pent-up demand. However, corporates in the UK – the only major economy still expected to enter a recession this year – continue to experience growing levels of distress, widening a gap that already exists with Germany, France, Italy and Spain.

UK economy continues to face significant headwinds, as corporates battle with higher inflation, higher operating costs and higher input costs. The Bank of England has increased base rates faster than the European Central Bank, meaning the cost of servicing and raising debt has also risen faster and more considerably in the UK.

The UK housing market is also struggling with the drag of higher mortgage rates and a sharper increase in the cost-of-living. Private rental prices paid by tenants in the UK increased by 4.4% in the 12 months to January 2023, representing the largest annual percentage change since this UK series began in January 2016. Consumer confidence and discretionary incomes remain squeezed – affecting two thirds of overall spend in the UK. It comes as Chancellor Jeremy Hunt announced that higher taxes will remain for the foreseeable in order to keep on top of public finances.

In terms of outlook, it should be noted that two million UK households have fixed rate mortgages coming to an end during 2023. These households will need to remortgage at elevated interest rates, resulting in an estimated additional hit to discretionary spending of £225 per month at current average rates of 4.7% on a £150,000 mortgage balance, according to Retail Economics. In many cases, affordability will be extremely tight. On the continent by contrast, most mortgages are taken out on floating rates.

Corporates in Germany were the second most distressed across the European markets included, but saw levels of distress moderate mildly on the previous quarter. This is likely to reflect a more optimistic outlook for the economy, given the expected avoidance of recession and stronger financial markets. With the economy reliant on manufacturing, ongoing softness in global demand continues to play a key role in distress expectations for German corporates.

Elsewhere in Europe, corporates headquartered in Spain and Italy continue to see levels of distress rise year-on-year, driven by pressure on investment metrics, weaker market fundamentals and poorer valuations. The greatest change on the previous quarter was seen across investment metrics which saw a sharp increase and now at its highest level since May 2020. Unlike other markets, pressures on liquidity appear to have eased in the latest data, albeit very marginally.

Meanwhile, levels of distress across corporates in France remained in positive territory for the seventh consecutive month, albeit just slightly above the long-run average. The macroeconomic environment in France appears more positive than many neighbouring European countries. The IMF has forecast economic growth of 0.7% in 2023, ahead of the UK, Germany and Italy.

Sector Trends

The largest driver of distress in the latest data came from businesses operating within Real Estate, driven by a squeeze on valuations, liquidity and weakening investment metrics. Ongoing pandemic impacts, particularly hybrid working, higher borrowing costs, and lower expectations of capital appreciation have all contributed to move challenging conditions.

Meanwhile, distress remains elevated across Retail & Consumer. The immediate pressure on liquidity and profitability continues to be a key challenge, as a weaker consumer outlook is set against rising operating costs, increasing borrowing costs and fierce competition.

Healthcare corporates have seen distress levels accelerate in the last quarter, caused by a deterioration across profitability, liquidity and valuation. In part, this is likely to reflect the rising cost of raising and servicing capital and higher operating costs while the positive impacts of demand throughout the pandemic have waned.

Distress also remains above the long-term average for Travel, Leisure & Hospitality companies, likely driven by leisure and hospitality players to a larger extent compared to travel operators who have reported strong demand.

Corporate distress can be defined as uncertainty about the fundamental value of financial assets, volatility and increases in perceived risk. It also refers to the disruption of the normal functioning of companies’ financial performance. There are several common characteristics of corporate distress: liquidity pressures, reduced profitability, rising insolvency risk, falling valuations and reduced return on investment.

Contributor(s)

More from the Weil European Restructuring Blog

This website is maintained by Weil, Gotshal & Manges LLP in New York, NY © 2020 Weil, Gotshal & Manges LLP, All Rights Reserved. The contents of this website may contain attorney advertising under the laws of various states. Quotation with attribution is permitted. This publication is provided for general information purposes only and is not intended to cover every aspect of the purpose for the law. The information in this publication does not constitute the legal or other professional advice of Weil London or the authors. The views expressed in this publication reflect those of the authors and are not necessarily the views of Weil London or of its clients. These materials may contain attorney advertising. Prior results do not guarantee a similar outcome.