The latest Weil European Distress Index reveals a mixed picture of economic recovery across Europe. Analysing data from over 3,750 listed corporations and financial market indicators, the Index shows a general decline in distress levels, highlighting positive developments in many of the continent’s major economies.

Whilst ongoing geopolitical and economic uncertainties persist across Europe, the outlook has improved compared to last year. Economic growth across the Euro area rose by 0.3% in the first quarter of 2024, beating expectations and marking an end to a mild recession. GDP is expected to rise 0.8% in the Euro area in 2024, a slight improvement from the previous forecast made by the European Commission. Additionally, inflation continues to moderate.

This progress is driven by a strengthening macroeconomic environment and the easing of the worst cost-of-living pressures. However, challenges remain, particularly in Germany, Spain and Italy, as well as within the Retail/Consumer Goods and Real Estate sectors.

Sector trends

The WEDI identifies that the Real Estate, Retail/Consumer Goods and Healthcare sectors remain above long-term distress levels, whilst improvements have been seen in Commodities, Financial Services and TMT.

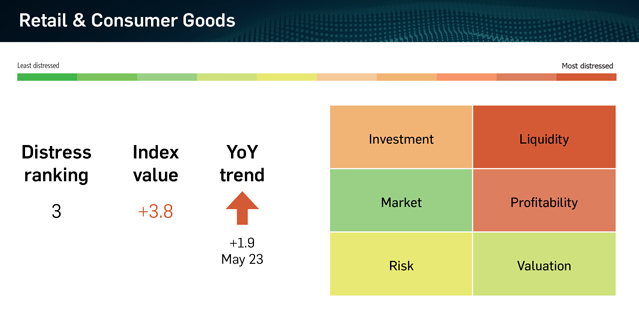

Most notably, the Retail and Consumer Goods sector has risen to the top three most distressed sectors in Europe, up from fourth place in Q1 2024. This climb reflects ongoing weaknesses in consumer spending and supply chain disruptions, exacerbated by tensions in the Middle East, which have increased freight and container costs and delayed product deliveries. Consumer spending is encountering challenges as households adapt to higher remortgaging rates and rising rents, impacting discretionary spending. This situation continues to pressure the sector, with businesses aiming to balance operational costs against consumer price sensitivity.

As has been the case for the past six quarters, Real Estate is the most distressed sector; however, distress levels have shown signs of easing. Property value declines have flattened following a two-year recalibration to higher interest rates, providing a more positive outlook compared to last year. Nevertheless, the outlook remains challenging, especially for those with high leverage ratios who are increasingly struggling with refinancing debt. Recent data shows that new lending to commercial real estate in the UK fell to a historic low in 2023, as lenders and investors grappled with falling property values, higher debt costs and pressure to address troubled loans. Total loan origination during the year was £33bn, the lowest in a decade.

Regional market trends

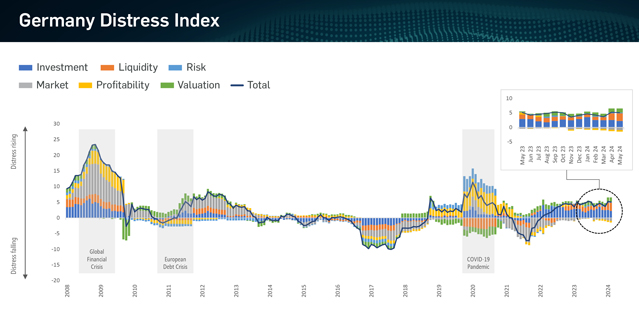

In Germany, corporates continue to face the highest distress levels in Europe. Challenges such as investment hesitancy, tighter liquidity and profitability issues reflect broader macroeconomic problems. The European Commission’s latest update describes Germany’s economy as stagnant throughout 2024, with investment remaining below pre-pandemic levels. Exports are expected to stay sluggish in 2024, with a slow recovery anticipated in 2025.

Corporate distress fell in the previous quarter in the UK and has continued to moderate over the last 12 to 16 months, supported by falling inflation and a tentative recovery in output. However, distress levels remain above the long-run average due to weaker investment metrics, pressure on profitability and tighter liquidity. The Bank of England has highlighted positive economic momentum, suggesting potential rate cuts, with a recent Reuters poll indicating 63 of 65 economists expect a rate cut in August, with further reductions likely by the end of the year. Both consumer and business confidence have improved, and post-election stability is expected to provide the clarity businesses need for decision-making.

France has seen distress levels marginally lower than last year, making it the least distressed market in the WEDI report. However, this could change following the snap parliamentary elections, which have highlighted the fragile state of the French economy. The European Commission has indicated that France, along with Italy and five smaller eurozone nations, might face Excessive Deficit Procedure measures due to budget deficits. Since President Emmanuel Macron announced the snap vote early in June, the French 10-year bond yield has risen by over 30 basis points, reaching levels not seen since the Euro area’s sovereign debt crisis a decade ago.

Elsewhere, Spain and Italy continue to experience levels of distress above the long run average and marginally higher than the previous quarter.

Contributor(s)

More from the Weil European Restructuring Blog

This website is maintained by Weil, Gotshal & Manges LLP in New York, NY © 2020 Weil, Gotshal & Manges LLP, All Rights Reserved. The contents of this website may contain attorney advertising under the laws of various states. Quotation with attribution is permitted. This publication is provided for general information purposes only and is not intended to cover every aspect of the purpose for the law. The information in this publication does not constitute the legal or other professional advice of Weil London or the authors. The views expressed in this publication reflect those of the authors and are not necessarily the views of Weil London or of its clients. These materials may contain attorney advertising. Prior results do not guarantee a similar outcome.