The Munich court has recently confirmed that certain financing structures sometimes referred to as ‘double-dips’ are valid under German insolvency laws in a recent ruling in the Wirecard AG bankruptcy. Weil’s German partners Britta Grauke and Matthias Eiden successfully represented the Luxembourg subsidiary’s insolvency receiver in this case, confirming that the upstream loan and parent guarantee claims against Wirecard AG lead to two separate claims in the insolvent estate. This structure and the court’s ruling provides useful guidance for investors in debt issued by German companies, secondary debt trading strategies and potential liability management structures going forward.

Wirecard – Structure of convertibles bonds

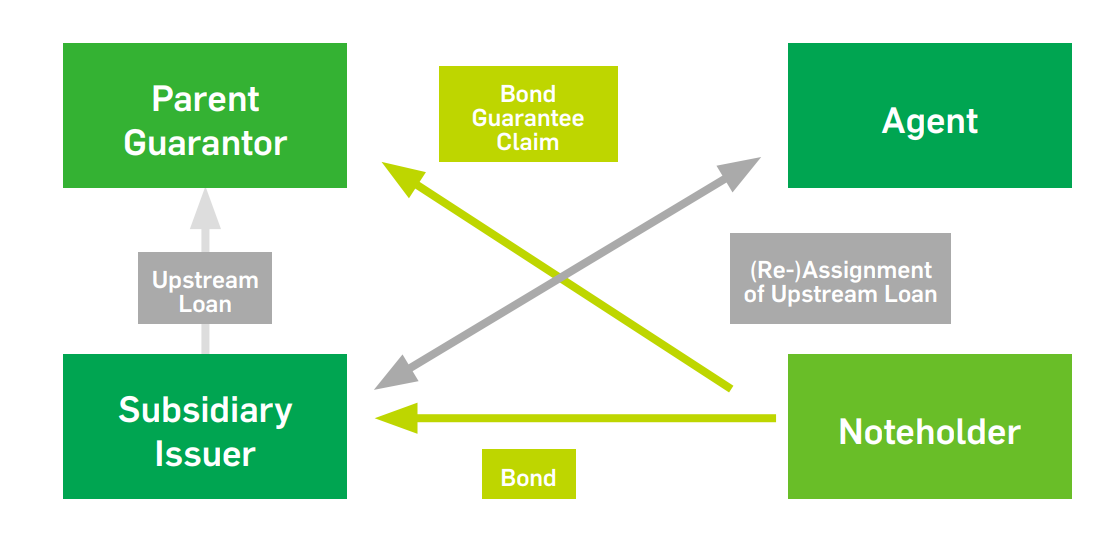

Steps:

- Subsidiary issued convertible Bond

- Parent Guarantor guaranteed the repayment of Bond

- Subsidiary on-lent proceeds to Parent Guarantor by way of Upstream Loan

- Upstream Loan claim stapled into tranches of EUR 100k appertaining to notional amount of Bonds and assigned to Agent ‘exclusively for purpose of conversion’.

- Upstream Loan claim assigned to Parent Guarantor in case of conversion (in order to extinguish at that level) OR re-assigned to Subsidiary in case of maturity of bond

Judgement: The Regional Court of Munich has approved the Subsidiary’s Upstream Loan claim and held (July 2, 2024 – file no. 40 O 5103/24)*:

The insolvency administrator of Wirecard took the position that the Upstream Loan should not be included in the ordinary unsecured claims of the bankruptcy estate. This decision was challenged by the Subsidiary, represented by Weil.

- The issuance of such structure is commonly used and does not give rise to concerns regarding public order or provide grounds for insolvency avoidance

- Under the agreed financing documents, the Subsidiary has become the owner of the Upstream Loan claim again following its effective reassignment from the Agent. The documents also entitle the Subsidiary to assert it in the Parent Guarantor’s insolvency (as opposed to the Agent during the period of its holding exclusively for the purpose of conversion).

- German insolvency law does not prevent the filing of the Upstream Loan claim. This does not lead to a (prohibited) double filing. The Loan and the Bond Guarantee are neither economically identical claims nor does the Upstream Loan claim constitute a recourse claim for the Bond Guarantee. As a consequence, the Subsidiary’s claim into the estate is not deferred. Rather, the agreements lead to independent and separate liabilities of Parent Guarantor.

- Notably, repayment of the Upstream Loan does not reduce the liability of the Bond (unless the Subsidiary uses such funds for repayment).

*The judgement has just been appealed before the Higher Regional Court of Munich.

Impact on financing structures // Improved avenue to recovery

- Wirecard has been the first case in Germany where such on-lending of proceeds stemming from the issuance of convertible notes has been tested in the insolvency of the parent guarantor.

- Still, the structure is relatively common, not only for German convertible notes but also in the UK / US. The Wirecard ruling aligns German law closer to English / New York law positions in that regard.

- The confirmation of this financing structure in the judgement may have two major consequences:

- Recovery of secondary debt investors:

- Investors should reflect into their recovery analysis that, by virtue of the on-lending, the issuer is entitled to an independent claim into the estate which may improve the financier’s avenue of recovery under the primary debt instrument.

- Absent any contractually agreed subordination, the Issuer’s claim ranks as a pro rata unsecured claim in the parent’s insolvency and looks at its unencumbered assets or senior ranking if it also benefits from security.

- Potential for new money structuring:

- In a distressed situation, the structure may serve as an attractive means for the group to secure much needed additional liquidity depending on restrictions under existing financing agreements.

- The court’s ruling also confirms that German issuers will be able to utilise these types of structures to implement liability management transactions in the future

Contributor(s)

More from the Weil European Restructuring Blog

This website is maintained by Weil, Gotshal & Manges LLP in New York, NY © 2020 Weil, Gotshal & Manges LLP, All Rights Reserved. The contents of this website may contain attorney advertising under the laws of various states. Quotation with attribution is permitted. This publication is provided for general information purposes only and is not intended to cover every aspect of the purpose for the law. The information in this publication does not constitute the legal or other professional advice of Weil London or the authors. The views expressed in this publication reflect those of the authors and are not necessarily the views of Weil London or of its clients. These materials may contain attorney advertising. Prior results do not guarantee a similar outcome.