The Galapagos Group has secured comprehensive affirmation of its 2019 debt restructuring (the “Restructuring”) from the English High Court. This decision is a significant step towards resolution of the highly contested restructuring, and provides market participants with further clarity and certainty when it comes to implementing lender-led transactions in future.

The key focus of the dispute before the English Court was the proper interpretation and application of the Distressed Disposal provisions often contained in LMA-style intercreditor agreements used in European leveraged finance transactions.

The key takeaways from the case are:

(a) there is no restriction under a typical LMA-style intercreditor agreement that prevents supporting creditors providing new funding to a restructured group (including where the new funding is provided as part of / to facilitate the restructuring);

(b) cash consideration requirements can be satisfied by way of set-off of competing payment obligations (ie, payment of actual cash tender is not necessary); and

(c) junior creditor value protections in typical LMA-style intercreditor agreements still need to be satisfied even where junior creditors are clearly out of the money.

Weil’s Neil Devaney (Partner, Restructuring), Matt Benson (Partner, Restructuring) and Jonny Woods (Counsel, Restructuring) represented the ad hoc group of holders of the SSNs (the “AHG”), which drove the implementation of the lender-led restructuring solution in this case.

The Stakeholders

At the time of the Restructuring, the Galapagos Group was owned by Triton Investment Partners and had the following financing arrangements in place (the “Original Debt”):

(a) a EUR 99.8m revolving credit facility (the “SSRCF”);

(b) a EUR 375m super senior guarantee facility (the “SSGF”);

(c) two series of senior secured notes due in 2021 (“SSNs”) issued by Galapagos SA (“GSA”) with an aggregate face value of EUR 525m (of which c. EUR 345m was outstanding); and

(d) a series of high-yield notes due 2022 (“HYNs”) issued by Galapagos Holding S.A with a face value of EUR 250m.

The Original Debt was secured by pledges granted by GSA over the shares in Galapagos Bidco S.à r.l. (“Bidco”), which itself was an intermediate holding company for the operating entities in the Galapagos Group. The rights of the creditors in respect of the Original Debt (the “Primary Creditors”) were governed by an English law intercreditor agreement (the “ICA”), which largely reflected the terms of the LMA-standard super senior intercreditor agreement with high yield notes.

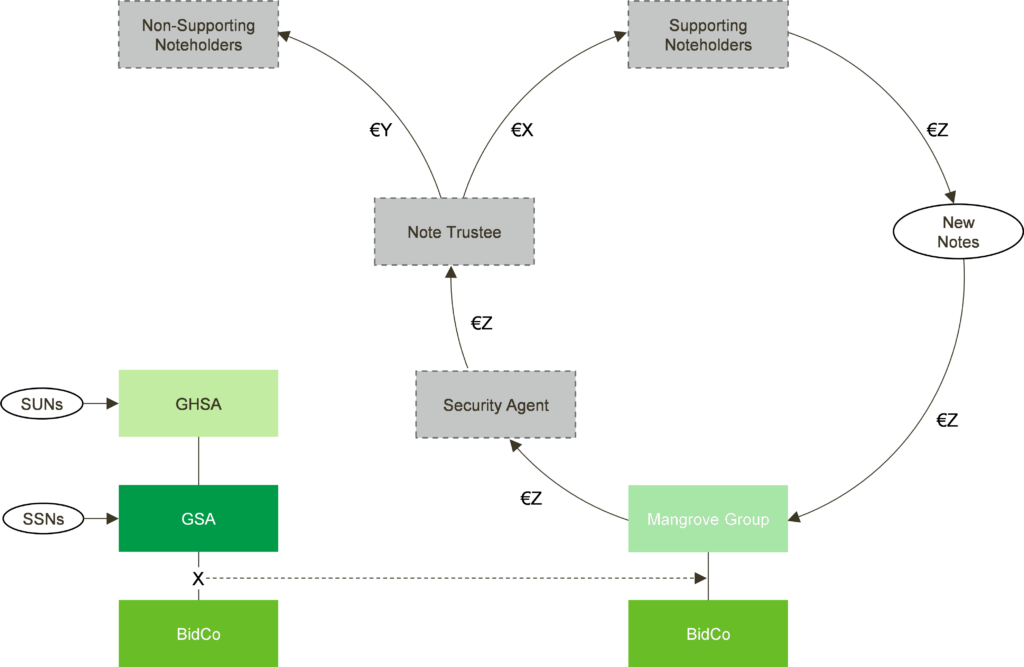

A diagram showing the relevant debts and Restructuring steps is set out at the end of this article.

The Restructuring was opposed by an ad hoc group of holders of the HYNs – which included Signal Credit Opportunities (Lux) Investco II S.à r.l. (“Signal”). In order to obtain clarity and certainty on the implementation of the Restructuring, Bidco commenced proceedings in the English courts seeking declaratory relief, joining Signal and the Note Trustees and Security Agent to the proceedings.

The judgment of Mr Justice Trower issued on 28 July 2023 provides detailed reasoning for granting declaratory relief to Bidco in support of the Restructuring, and rejecting the challenges made by Signal.

The Restructuring

The Restructuring involved a ‘Distressed Disposal’ under the terms of the ICA. Upon the instruction of the SSNs, the Security Agent sold the entire share capital of Bidco to Mangrove Luxco IV S.à r.l. (“Mangrove IV”) a company ultimately owned by Triton, for a purchase price of EUR 424,631,585.

The disposal proceeds were to be applied towards repayment of the Original Debt in the order of priority mandated by the distribution waterfall in the ICA and the Security Agent was instructed to release the liabilities owed to the Primary Creditors and associated security in accordance with the Distressed Disposal regime in the ICA.

Critically, the Security Agent was empowered under the ICA to release the HYN liabilities without requiring the consent of the HYN holders, and notwithstanding that they received zero proceeds from the disposal.

The purchase price was funded by a combination of:

(a) part of a EUR 140m equity contribution provided to the Mangrove group by Triton; and

(b) a series of new 7.775% senior secured notes due 2025 (the “New Notes”) with a face value of EUR 356,233,492.

Existing SSRCF and SSGF lenders also provided the following new facilities to the Mangrove group as part of the Restructuring:

(a) a new EUR 65m revolving credit facility; and

(b) a new EUR 260m super senior guarantee facility,

(together with the New Notes, the “New Financing”).

The New Notes were offered to all holders of the SSNs, and backstopped by members of the AHG to ensure that Mangrove IV had sufficient funding to complete the acquisition. Ultimately, a substantial proportion of the holders of the SSNs supported the Restructuring and elected to subscribe for their pro rata share of the New Notes.

To mitigate the need to distribute cash to the Security Agent and onwards through the clearing systems, a significant proportion of which would simply have ended up back in the hands of the same entities that were subscribing for New Notes, the parties agreed to issue a series of payment directions and set-off confirmations to reduce the number and amount of payment flows required to close the Restructuring. Ultimately, the Security Agent’s obligation to pay EUR 274,676,540 of disposal proceeds to the re-subscribing noteholders (€X in the diagram below) was discharged by way of set-off against Mangrove IV’s obligation to pay the same amount of the purchase price to the Security Agent (€Z in the diagram below).

The ICA Distressed Disposal Conditions

Signal argued that the Distressed Disposal provisions in clause 17.4 (c) of the ICA (the “Distressed Disposal Provision”), which permitted the Security Agent to release the HYN claims against the disposed entities without HYN consent, were not complied with. Their overarching complaint was that the apparent purpose of the Distressed Disposal Provision was to ensure that secured assets are disposed for cash consideration and on a ‘debt-free’ basis, which precludes senior creditors from effecting a distressed disposal and release of junior liabilities whilst ‘in substance’ maintaining their senior claims against the Group by providing ‘new’ or replacement financing as part of the restructuring.

Under the terms of the Distressed Disposal Provision, in order for the secured assets to be sold and HYN claims against the disposed assets to be released without the HYN holders’ consent:

(a) The proceeds of sale or disposal had to be in cash (or substantially in cash) (“Condition A”).

Signal argued that:

- the issue of New Notes was consideration which was not “cash”, and payment by way of set-off was not payment “in cash”;

- one of the purposes behind Condition (A) was to prevent the payment of deferred consideration, which was not fulfilled because amongst other things, the issue of New Notes were to be treated as substantial consideration for the key secured assets.

(b) All claims of the Primary Creditors were to be unconditionally released and discharged concurrently with the sale (and not assumed by the purchaser or one of its affiliates) (“Condition B”). That is, the Security Agent cannot sell the secured assets for nominal consideration but subject to the relevant existing indebtedness.

Signal argued that:

- the releases had to be considered in the context of the pre-ordained, inter-conditional steps of the parties in the lock up agreements which involved the provision of the New Financing. Condition B, which required an unconditional release and discharge concurrently with the Distressed Disposal, had not been satisfied. The commercial reality was that the senior ranking claims had not been released, but continued, and had in substance been assumed by the Mangrove group within the meaning of Condition B; and

- the release of the senior ranking liabilities was not unconditional, as the Restructuring was predicated on the New Financing being available.

(c) The sale or disposal had to be made pursuant to a public auction, or a financial adviser’s opinion obtained (“Condition C”). This was not in dispute in the case.

Findings On Satisifaction of Condition B

Mr Justice Trower dealt with Condition B first and rejected Signal’s arguments, stating that to accept Signal’s submission would be “to accept the imposition of a highly significant restriction on the rights of senior creditors”. In doing so he found:

(a) There was nothing in the language of Condition (B) which spelt out any form of prohibition restricting the SSNs and other Primary Creditors from agreeing to lend money to the purchaser to enable it to fund the purchase consideration;

(b) The ICA was clear that the release required was of the Primary Creditors’ claims in their capacity as such and not as a creditor under the New Notes or new guarantee facility;

(c) The purchaser had not assumed the Primary Creditors’ liabilities under the Original Debt. The New Financing including the issue of the New Notes was issued by a different debtor and was legally distinct from the Original Debt. The purchaser and the restructured Group had incurred new liabilities under the New Financing, none of which was governed by or affected by the terms of the ICA;

(d) It was plain that the purpose of Condition B was to ensure that in the context of a Distressed Disposal the release of existing liabilities was obtained. It was an unjustified leap in logic to say it therefore follows that all or some of the Primary Creditors could not be creditors of the Group under alternative financing arrangements once the Distressed Disposal was completed. This was the case even where the re-lending was not just concurrent with the sale but was also made in a pre-arranged manner in conjunction with the sale. He went on to say:

- This would be a wholly uncommercial consequence because it would “seriously restrict the ability of the Lenders to obtain a recovery on their claims particularly in times where there is a shortage of liquidity in the market” as Eder J put in in Stabilus. It would remove from the potential pool of refinancing lenders those who are most likely to have an appetite to continue to support the Group with new finance, which as a matter of practical necessity would have to be available at the time the restructuring is being put in place.

- It would also have a very significant adverse impact on the rights of the senior creditors to utilise the funds to which they were entitled under the distribution waterfall in their own interests and would give the holders of the HYNs a very significant negotiating position extending well beyond any legitimate interests they may have in ensuring that the value of the underlying business is realised in full.

(e) As to Signal’s argument that the releases were not unconditional because they were all pre-ordained, inherently interlinked and contractually required to be taken in accordance with the Restructuring Deed, this did not mean that each release was anything other than an unconditional release and discharge in accordance with the Condition B requirements.

Findings On Satisfaction of Condition A

Mr Justice Trower rejected Signal’s arguments that Condition A was not met, finding:

(a) The consideration for the Distressed Disposal was Mangrove IV’s promise to pay the sum of EUR 424,631,585 in cash. The issue of the New Notes was not to be treated as consideration for the disposal. There was no reason in principle why the holders of the SSNs should not be entitled to do whatever they liked with the money they received through the waterfall under the ICA, including for the purpose of subscribing for new debt securities issued by the purchaser;

(b) A provision for the proceeds of a sale or disposal to be “in cash” or “substantially in cash” will not exclude a right of set-off as a method of discharging an obligation to pay in cash. There was nothing in the ICA to restrict the SSN holders from re-lending their proceeds and directing that the cash otherwise distributable under the waterfall should be applied as a set-off against the subscription price for the New Notes; and

(c) Consistent with a long line of English authority, set-off of competing payment obligations constitutes payment ‘in cash’ as a matter of English law.

In his judgment, the real purpose of Condition (A) was to ensure that the proceeds of the Distressed Disposal are identified and valued in cash, which can provide immediate certainty as to the value of the consideration and can facilitate the reliability of a financial advisers’ opinion or public auction as to value.

Do Junior Creditor ICA Protections Apply Where They Are Out Of Money?

Bidco’s fall back position was that Conditions (A) to (C) were not required to be satisfied if the HYN holders had no economic interest in the Group and would receive no return if the Distressed Disposal did not occur.

Bidco had argued in those circumstances, the HYN holders would have no legitimate interest in enforcing compliance with those conditions as compliance would not provide them with any return. The ICA did not expressly say what would happen in the event that the HYN holders were out of the money, but Bidco argued that this construction followed as a matter of business sense, which was either the consequence of the proper reading of the ICA or an implied term on the grounds that it was so obvious as to go without saying or necessary for business efficacy.

Given his findings on Conditions (A) and (B), it was not necessary for Mr Justice Trower to determine the point but he considered the argument and disagreed with the approach. He found:

(a) Such a construction was inconsistent with the drafting of the ICA, which was a complex document in which the drafter had sought to provide for a range of different eventualities. It would also give rise to practical difficulties in implementation;

(b) Conditions (A) to (C) obviated the need for an uncertain and potentially litigious enquiry into value; and

(c) It was important to construe the ICA in a way which provided for a reasonable degree of commercial certainty and predictability. The need for an open enquiry as to value at that stage where the instructing party would want the Security Agent to act quickly would be inconsistent with business common sense.

These factors pointed against the implication of the suggested term and more generally a construction of the ICA which introduced a disapplication of the need to satisfy conditions (A), (B) and (C) if the holders of the HYNs were out of the money. However, he also went on to find that, if contrary to his view conditions (A) to (C) were not required to be met, the HYN holders were out of the money at the time of the Distressed Disposal.

Conclusion

This case provides useful and timely guidance for the implementation of lender-led restructuring transactions as we move into another restructuring cycle. Market participants now have further clarity and certainty on the ability to utilise Distressed Disposal mechanisms, based on typical LMA-standard form intercreditor arrangements, to implement lender-led restructurings.

Whilst there are still some battles to be won in relation to the Galapagos Group restructuring (including an appeal in Germany in relation to certain claw-back claims, which were dismissed at first instance), this judgment is a critical step forward in closing out this chapter.

Galapagos Restructuring Steps and Payment Flow

Contributor(s)

More from the Weil European Restructuring Blog

This website is maintained by Weil, Gotshal & Manges LLP in New York, NY © 2020 Weil, Gotshal & Manges LLP, All Rights Reserved. The contents of this website may contain attorney advertising under the laws of various states. Quotation with attribution is permitted. This publication is provided for general information purposes only and is not intended to cover every aspect of the purpose for the law. The information in this publication does not constitute the legal or other professional advice of Weil London or the authors. The views expressed in this publication reflect those of the authors and are not necessarily the views of Weil London or of its clients. These materials may contain attorney advertising. Prior results do not guarantee a similar outcome.