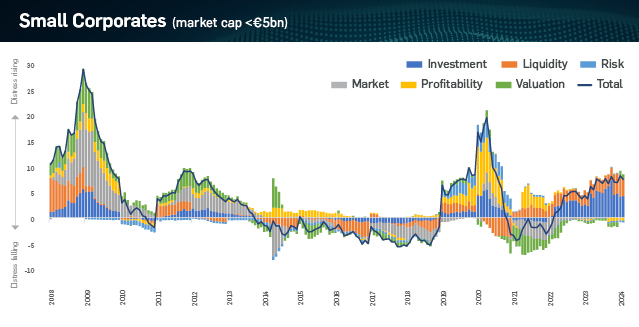

Corporates across Europe have experienced an increase in distress levels during the first quarter of 2024, as highlighted by the latest Weil European Distress Index. Analysing data from over 3,750 listed corporates and financial market indicators, the Index reveals heightened vulnerability amongst industries which are capital-intensive and highly leveraged. This trend underscores the varied impact of current economic conditions, including fluctuating interest rates and market valuation challenges.

A notable concern arises from corporate debt refinancing, particularly for businesses reliant on significant capital investments or facing imminent refinancing needs in the 2024/25 timeframe. These challenges are further compounded for smaller enterprises, which typically have lower credit ratings and are therefore more vulnerable to interest rate increases. This sensitivity to rate hikes, combined with tighter liquidity conditions, is placing significant strain on their ability to manage debt and sustain operations.

Sector Trends

The Retail and Consumer sector, one of the four most distressed areas, faces a significant downturn in consumer spending. This decline, fuelled by rising interest rates and mounting household debt burdens – especially amongst millennials (30-44 years) who are often the most highly indebted and over-stretched – is taking a toll on retail businesses across all price segments. As a result, the sector is experiencing a downturn in performance and a surge in insolvencies, highlighting serious concerns about its resilience amidst widespread economic pressures.

Recent developments in the Industrials sector are also causing concerns, with distress levels increasing since the previous quarter. Known for its capital-intensive nature and susceptibility to economic fluctuations, the sector is now grappling with supply chain disruptions, particularly in the Red Sea region. These disruptions have led to increased costs and delays, prompting some companies to halt certain European productions due to component shortages – a direct consequence of the ongoing disruptions. Notably, 45% of industrial companies analysed in the Index are based in Germany. This concentration in a country facing serious economic challenges, currently considered the weakest amongst advanced economies, highlights a critical juncture where regional economic vulnerabilities and sector-specific challenges converge.

The European Real Estate market, which remains the most distressed sector across Europe, continues to face significant distress, with falling investment metrics and high interest rates posing challenges. Leveraged firms are grappling with rising costs, declining property values and refinancing complexities due to tighter liquidity and depreciating valuations.

Elsewhere, the Healthcare sector is experiencing a slight easing in distress due to improved liquidity. However, the dual pressures of escalating interest rates and growing debt servicing burdens continue to disproportionately impact leveraged firms.

Regional Market Trends

Germany continues to be the most distressed market, impacted by a reluctance to invest, liquidity shortfalls and profitability dilemmas in a slow-growth economy. Germany’s economic forecast for 2024 shows minimal growth, with risks heightened by its reliance on exports and labour market rigidity. There is looming concern for a potential recession, with economic output at risk of declining in early 2024. Germany’s industrials sector is particularly strained by high interest rates, skilled labour deficits and extensive regulations, leading to more insolvencies. However, signs of easing inflation, stable unemployment and lower energy costs offer some optimism for recovery within the next year.

In contrast, the UK has seen corporate distress stabilise, aligning closely with levels observed in the previous quarter. Nevertheless, the persistently high-interest-rate environment remains a source of pressure for firms, grappling with increased debt service costs, stricter refinancing conditions and diminished demand. Despite the onset of a recession in late 2023, promising indicators such as declining inflation, a resilient job market and growing consumer confidence suggest a potential brief downturn.

In France, distress levels have stayed above average for nearly a year, ranking it as the third most distressed in the Index. Contributing factors include liquidity pressures, weakening investment metrics and a decline in risk appetite. GDP growth has stalled, and, despite a previous upward trend, consumer confidence dipped in February, with retail sales also continuing to decline.

Meanwhile, Spain and Italy show a brighter economic outlook, with distress levels declining and growth projections for 2024 more optimistic than their European peers, positioning Spain for the second-fastest growth rate amongst advanced economies.

Contributor(s)

More from the Weil European Restructuring Blog

This website is maintained by Weil, Gotshal & Manges LLP in New York, NY © 2020 Weil, Gotshal & Manges LLP, All Rights Reserved. The contents of this website may contain attorney advertising under the laws of various states. Quotation with attribution is permitted. This publication is provided for general information purposes only and is not intended to cover every aspect of the purpose for the law. The information in this publication does not constitute the legal or other professional advice of Weil London or the authors. The views expressed in this publication reflect those of the authors and are not necessarily the views of Weil London or of its clients. These materials may contain attorney advertising. Prior results do not guarantee a similar outcome.